Special Reports: Capital Markets December 2022

Into the Unknown

Will Capital Markets Liquidity Revive?

December 2022

Excerpt of Full Report:

Fed Policy Tightening Prompts Caution from Lenders — Key Trends to Look for in the Year Ahead

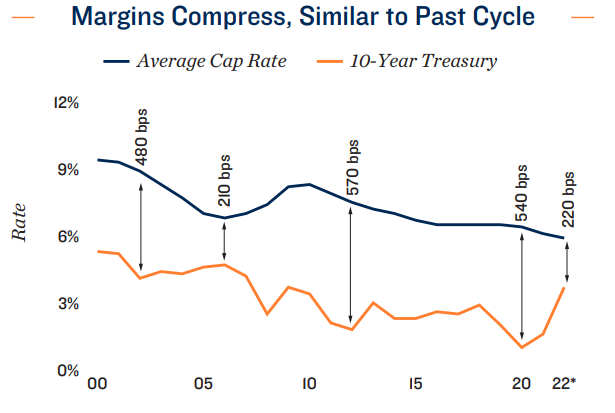

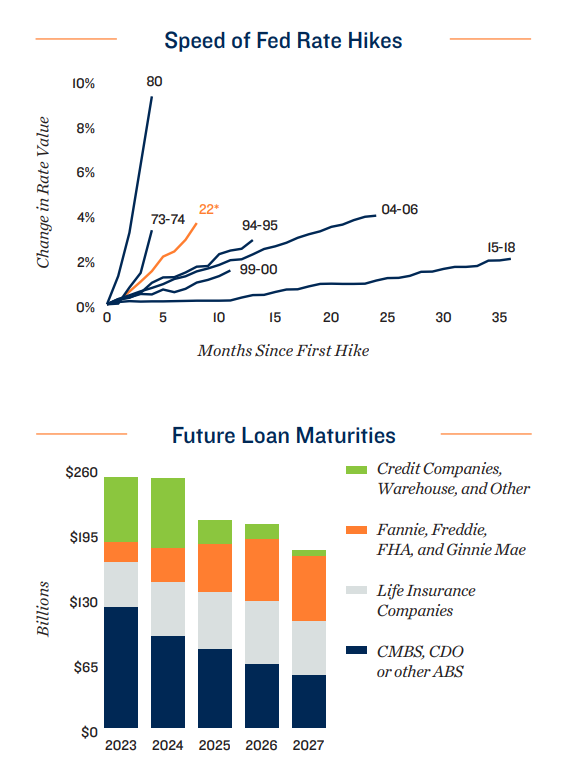

As the Federal Reserve continues its rate hikes to curb inflation, the capital markets have responded with overwhelming caution until there is clarity on when the Fed will stop and where interest rates are likely to settle. Several questions compound this uncertainty, including volatility in the stock market, geopolitical risk, decelerating rent growth, falling home prices, and cap rate inflation. Lenders and investors alike are taking an observant pause to avoid “catching a falling knife,” while using this time to raise funds for what they believe will be impending distress in the commercial real estate market, much like they did in 2020 after the onset of the pandemic. In 2020, the capital providers that took the risk to lend or invest tended to come out on top, while much of the market missed the opportunity, due to an abundance of caution

A recent client survey conducted by Marcus & Millichap concluded that the availability of financing is a top concern among investors for 2023. While no one has a crystal ball, this report will discuss some of the potential trends that the capital markets may have in store for the coming year. These eight prognostications are based on a few key assumptions, including that the Fed eases up a bit on its pace of rate hikes, the economy weakens modestly — but doesn’t plummet — and there are no other unexpected black swan events or catastrophes.

Cash Becomes King

Well-Capitalized Investors Can Capitalize on Market Dislocation, while Highly-Leveraged Borrowers May Face Challenges

Expect higher leverage options to remain less available — particularly for construction loans, renovation loans, and other highly transitional business plans. This is due, in part, to constraints in debt service coverage ratios that are trumping debt yield and loan-to-value limits for the first time in recent history. As interest rates rise, leverage will reduce further, leading to a necessity for price decreases to hit target yields. All cash buyers, or buyers who can take a lower leverage level of “negative leverage,” will be able to acquire assets at lower price points, as they will not be held hostage to the current capital markets environment.

Rescue Capital

Mezzanine Debt and Preferred Equity Capital Will Once Again be Prevalent and Available for Pending Maturities

A massive $121 billion of maturities in the CMBS/CDO market alone will hit next year in a landscape fraught with volatility and uncertainty. A substantial amount of capital is being poured into commercial real estate funds that are designed to take advantage, expecting 15 percent to 20 percent-plus internal rate of returns. Mezzanine debt and preferred equity are the easiest placement positions for this capital, as there is no need to seek leverage from outside sources. Expect this capital to initially target multifamily and industrial assets that cannot refinance out construction, bridge, or possibly even maturing perm debt.

This rescue capital will seek to “fill the gap” between the maturing debt positions and where new perm debt is constrained, based on DSCR, for vehicles like agency debt, insurance company debt, bank debt, and CMBS debt. These subordinate debt players will be leverage constrained based on asset basis and debt yield, rather than DSCR. As the year winds on and the amount of capital chasing these product types is greater than the opportunities available, expect these funds to start considering hospitality, retail, and select office transactions as well.

Construction Financing Limited

Groundbreakings Slow Down until Construction Costs Retreat, Due to Investor Underwriting

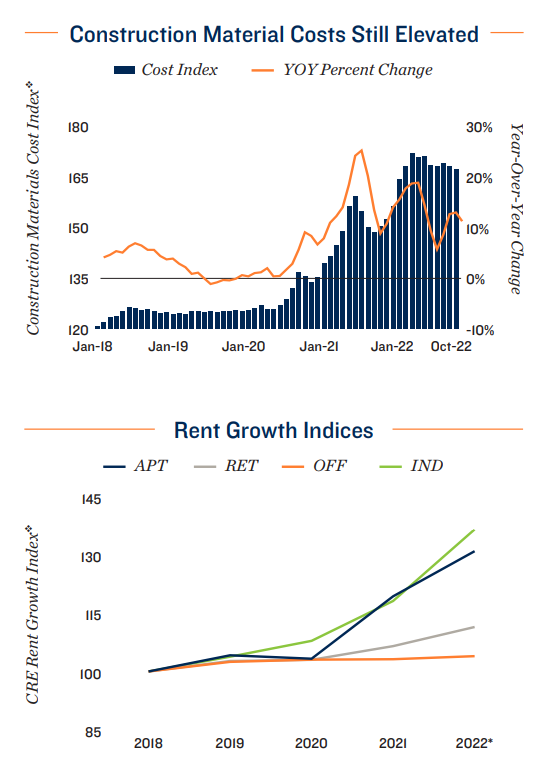

While history generally shows that building in a time of crisis tends to pan out well for those who are fortunate enough to capitalize their transactions, developers will have a difficult time proving to limited partnership investors that their transactions pencil. While construction costs have begun to decelerate, expenses are still at historically elevated amounts. Like the period after the great financial crisis, there can often be no level at which a land buy pencils for LP investors who will conservatively underwrite higher exit cap rates to account for possible cap rate inflation.

Deglobalization and housing supply/demand imbalances may continue to foster double-digit compounded growth for some industrial and multifamily locations. However, the LP equity for new development is likely to be limited, as investors will not be willing to underwrite the high rent growth necessary to offset potential cap rate inflation. The lack of development that results from this method of underwriting may exacerbate supply/demand imbalances, and lead to even greater rent growth in some markets and product types. As construction costs eventually decline, investors will re-evaluate, but expect many developers to put their development deals on hold or try to trade their land at discounts to well-capitalized buyers.

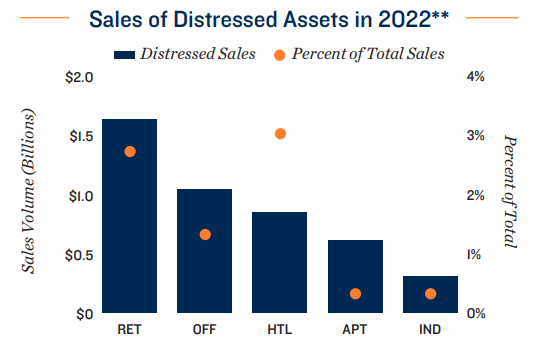

Distressed Sales

Distressed Purchases Will be Prioritized by Bridge Lenders

Buyers of distressed debt, real estate owned, and other existing assets from distressed buyers will be prioritized by bridge lenders, due to their “reset basis” that will be deemed to be more in line with current valuations. Higher leverage bridge lending may be available for these transactions, albeit at a still elevated cost of capital levels. Both performing and non-performing debt will be traded at elevated levels, as lenders clear allocation and potential workout issues from their balance sheets. Debt buyers who have experience purchasing debt and working out loans with borrowers will have increased opportunity.

A Thaw on the Horizon

Perm and Light Transitional Bridge Spreads Eventually Decline, Leading to More Activity

As the Fed starts to ease up on rate hikes and it becomes apparent that inflation is rapidly decelerating, bond investor sentiment will improve, leading to tighter spreads on CMBS and CLO tranches. This should lead spreads to decline on both CMBS perm loans and light transitional bridge debt. The decrease in spreads may offset some of the future Fed rate hikes in the base rate. This will lead to all-in rate levels not too dissimilar to those obtainable now, but with the added benefit of increased lending options and competition. Eventually, the increased competition will lead to more bridge lenders providing financing on more highly transitional assets and less desired product types as well.

A Huge Uptick in For-Sale Housing & Condo Inventory Lending

As unsold for-sale product absorption declines in the face of rising interest rates, borrowers will seek to refinance their maturing construction loans with condo inventory loans, collateralizing unsold units in order to buy more term to sell them out. Expect high-yield private money and debt fund capital to chase after these opportunities and lend at a reasonable reduced basis level that they feel comfortable with in markets they are familiar with.

As Inflation Subsides and Fed Slows Down, Pent-up Capital for CRE Transactions is Released

While the capital markets will likely stay relatively constrained in the near term as the Fed marches on with its rate hikes, expect the capital markets to thaw progressively over the year as inflation is reined in. Much of the inflation data lags by about half a year, and more of the raw data suggests inflation is already greatly reduced, more than it is showing in current CPI figures. As the results are released, the Fed should eventually start to indicate a slowing or stopping of rate hikes, after which lending will pour back into the market in force. This could potentially drive down spreads faster than expected, due to the amount of liquidity already present and growing for CRE transactions.

Where base rates will settle is anyone’s guess, but expect the current all-in rate environment to stay for an extended period. It is prudent to take the appropriate maneuvers to mitigate risk for existing assets, but also figure out ways to otherwise profit from market dislocation as we head into the unknown.

Denver Office:

Adam Lewis Vice President, Regional Manager

Tel: (303) 328-2000 | adam.lewis@marcusmillichap.com

Prepared and Edited By:

Benjamin Kunde Research Analyst | Research Services

For Information on national multifamily trends, contact:

John Chang Senior Vice President, National Director | Research Services

Tel: (602) 707-9700 | john.chang@marcusmillichap.com

The information contained in this report was obtained from sources deemed to be reliable. Every effort was made to obtain accurate and complete information; however, no representation, warranty or guarantee, express or implied, may be made as to the accuracy or reliability of the information contained herein. Note: Metro-level employment growth is calculated based on the last month of the quarter/year. Sales data includes transactions sold for $1 million or greater unless otherwise noted. This is not intended to be a forecast of future events and this is not a guaranty regarding a future event. This is not intended to provide specific investment advice and should not be considered as investment advice. Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc.; Real Capital Analytics; RealPage, Inc. © Marcus & Millichap 2021 | www.MarcusMillichap.com