Research Brief: Housing Market July 2022

Early Signs of Housing Price Recalibration as Higher Interest Rates Stunt Affordability

June 2022

Excerpt of Full Report:

Prospective buyers deterred by decade-high mortgage rates. The Fed increased its overnight rate for a third time this year in mid-June to a target range of 1.50 to 1.75 percent, an aggressive response to persistent inflation as the Consumer Price Index climbed at its fastest pace in over 40 years in May. The Fed messaged its intent to continue lifting rates to temper inflation in the coming months, likely sustaining upward pressure on the cost and criteria to obtain a home mortgage. The average rate for a 30-year fixed-rate mortgage in the U.S. soared to 5.8 percent in the second half of June, up more than 250 basis points from the start of this year and the highest register since 2008. With home prices still at historic levels, this has presented another hurdle for potential buyers, leading to a notable slowdown in sales activity.

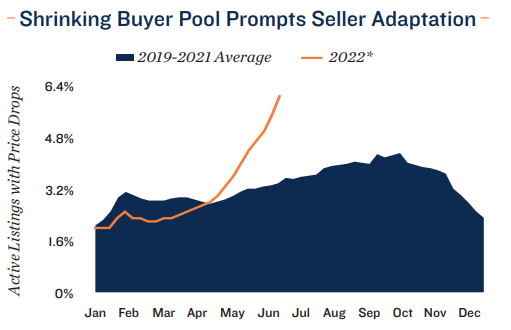

Owners adapt as affordability collapses buyer pool. Fewer existing homes sold in May than in any month since the second quarter of 2020. This moderation coincided with a six-month high in the number of home listings, a signal that purchases are now being reduced by forces other than a low for-sale inventory. During much of the past two years, the lack of homes on the market was the predominant buying constraint, but affordability is beginning to have a heavier influence. Single-family brokerages noted declines in tour requests and other engagements in recent weeks, prompting sellers to be slightly less aggressive with pricing as the market begins to settle. Still, the median price of an existing home rose for a 24th consecutive month to $403,300 in May.

Developing Trends

Multifamily serves as a relief valve. The relational value of rentals is improving as trends in the single-family housing market play out. In many instances, multifamily complexes are in better locations than homes that align with the budgets of most first-time buyers. At the same time, some apartments offer amenities, services and community-based activities that single-family homes do not. With many consumers tightening their spending amid high inflation, the cost-saving benefits of rentals, paired with these attractive lifestyle elements, is driving multifamily performance. Preliminary estimates for the second quarter show exceptionally strong rent gains, comfortably exceeding double-digit year-over year growth nationally, propelled by continued tight vacancy

Single-family builders tap the brakes. In May, the number of construction permits for single-family houses descended to a 10-month low. Developers are responding to a variety of factors, including record-high material costs that are still rising, lingering labor shortages and the potential for truncated buying activity. A slowdown in construction will exacerbate the housing shortage.

Denver Office:

Adam Lewis Vice President, Regional Manager

Tel: (303) 328-2000 | adam.lewis@marcusmillichap.com

Prepared and Edited By:

Benjamin Kunde Research Analyst | Research Services

For Information on national multifamily trends, contact:

John Chang Senior Vice President, National Director | Research Services

Tel: (602) 707-9700 | john.chang@marcusmillichap.com

The information contained in this report was obtained from sources deemed to be reliable. Every effort was made to obtain accurate and complete information; however, no representation, warranty or guarantee, express or implied, may be made as to the accuracy or reliability of the information contained herein. Note: Metro-level employment growth is calculated based on the last month of the quarter/year. Sales data includes transactions sold for $1 million or greater unless otherwise noted. This is not intended to be a forecast of future events and this is not a guaranty regarding a future event. This is not intended to provide specific investment advice and should not be considered as investment advice. Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc.; Real Capital Analytics; RealPage, Inc. © Marcus & Millichap 2021 | www.MarcusMillichap.com