Research Brief: Employment April 2022

Falling Unemployment Reiterates Broad Job Recovery; Investor Sentiment Strong

April, 2022

Excerpt of Full Report:

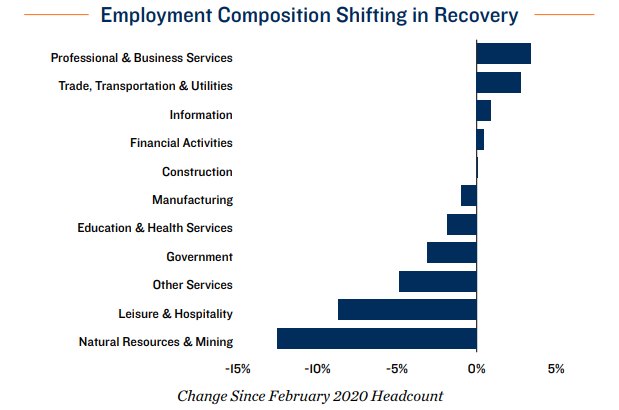

Unemployment rate nears parity with pre-pandemic. Staff counts expanded by 431,000 in March, helping lower the unemployment rate to 3.6 percent — only 10 basis points above the February 2020 measure. Weekly initial jobless claims have also fallen to levels comparable with before the health crisis. Overall, the labor market has generally returned to where it was just about two years prior, which is a more rapid improvement than in previous recessions. It took over three years for the employment base to return to its previous size, following the dot-com bubble, and about double that for the Global Financial Crisis; however, the composition of the labor pool has changed. Some sectors have expanded to new highs, while others continue to lag. It is in these areas, such as with leisure and hospitality positions, where employment growth is expected to be concentrated in the coming months..

More office-using employees return to workplaces. Major employers like Citigroup, BNY Mellon and Google brought more workers back to offices in March. While not all staff members are abandoning their home workstations entirely, even a hybrid return solidifies demand for office space. The growing pool of positions in traditionally office-using fields will also help compensate for lost space demand from permanent remote workers. Total employment across commonly office-based fields has grown 790,000 positions above the February 2020 count — a 2.4 percent expansion. As more workers transition from home to office, vacancy at such properties should decline, especially if COVID-19 case counts stay low.

Hiring trends reflect strength of many retailers. Another sector that has extended payrolls above the pre-pandemic measure is retail trade, with 278,000 more workers than in February 2020. E-commerce spending, as a share of total retail sales, has also returned to a pre-health crisis trend line. Together, these factors reflect a growing comfort and interest by consumers in visiting physical retail locations. Preliminary first quarter numbers show retail vacancy declining across the nation’s suburbs. As offices reopen, retail fundamentals should also improve in downtown areas.

Developing Trends:

Fed kicks off rate hike plan. Last month the Federal Reserve raised the Federal Funds Rate for the first time since 2018, in what might be the start of seven hikes this year. The inflation-limiting policy change has multiple economic implications. Climbing mortgage rates could temper the hot housing market, while steeper costs of capital for businesses may alter their labor needs down the line. Higher interest rates could also affect commercial real estate trades, as margins narrow relative to cap rates. Property yields may not rise in tandem with borrowing costs, given robust investment demand and new capital inflows.

Investor sentiment improves, despite some headwinds. Marcus & Millichap’s Investor Sentiment Index climbed to its highest level since 2015. While investors are keeping eyes on rising interest rates, inflation, economic and geopolitical issues, a majority still intend to acquire more commercial properties this year. Overall, investors are anticipating growing their real estate portfolios by an average of 12 percent in the second half of 2022.

Denver Office:

Adam Lewis Vice President, Regional Manager

Tel: (303) 328-2000 | adam.lewis@marcusmillichap.com

Prepared and Edited By:

Benjamin Kunde Research Analyst | Research Services

For Information on national multifamily trends, contact:

John Chang Senior Vice President, National Director | Research Services

Tel: (602) 707-9700 | john.chang@marcusmillichap.com

The information contained in this report was obtained from sources deemed to be reliable. Every effort was made to obtain accurate and complete information; however, no representation, warranty or guarantee, express or implied, may be made as to the accuracy or reliability of the information contained herein. Note: Metro-level employment growth is calculated based on the last month of the quarter/year. Sales data includes transactions sold for $1 million or greater unless otherwise noted. This is not intended to be a forecast of future events and this is not a guaranty regarding a future event. This is not intended to provide specific investment advice and should not be considered as investment advice. Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc.; Real Capital Analytics; RealPage, Inc. © Marcus & Millichap 2021 | www.MarcusMillichap.com