Special Report

Multifamily Report Summer 2020 - June, 2020

The Resilience of Multifamily Will Be Tested by the Short-Term Shock of COVID-19; Robust Underlying Dynamics Underpin an Optimistic Long-Term Perspective

Well-established multifamily fundamentals support a rebound on the horizon. The underlying dynamics of the apartment industry remain sound despite short-term challenges. One of the key drivers behind rental housing, the age 20-34 cohort, which makes up roughly one-fifth of the population, will continue to have a high propensity to rent. The affordability gap between renting and owning remains substantial, exacerbated by the situation at hand, making renting a more viable option for many. It was anticipated that in the coming years a wave of young adults would be ready to transition toward home ownership. However, a softened economy and unsettled housing market may delay these plans, keeping the cohort renting for longer. Looking beyond the clouds of uncertainty, these robust underlying demand drivers will support the multifamily sector through headwinds, and the disruption will likely play out as a correction rather than a fundamental downshift.

Turbulence will be felt within the industry in the near term. The wide-reaching economic disturbance will lead to a temporary yet substantial decline in household formation as more people consolidate living situations to reduce costs. Many tenants do not have sufficient savings to meet expenses without an income and may not be able to make rent payments. Workforce housing faces the steepest hurdles in the short term, with their tenant base less likely to have emergency savings to fall back on. Lower-skilled workers could find it difficult to obtain employment in a weakened labor market. The economic impacts of high unemployment will bleed into mid-tier and upper-tier space as more high-wage positions are cut and corporations freeze hiring and pause raises. Until the virus is contained, leasing activity will lag behind historical averages of the typical busy summer season as shelter-in-place orders and concerns of infection will keep people hunkered down. New construction faces obstacles in building tenant rosters, and concessions within the Class A segment may initiate a ripple effect that subdues rental rates across the industry in the short term.

Efficiencies discovered during the pandemic will become lasting industry changes. Societal trends and contact-less precautions will likely carry on beyond the end of the stay-at-home orders. Owners and developers can benefit from these changes by being more innovative in their offerings. Properties with touch-less entry systems, efficient e-commerce and food delivery, and work-from-home amenities will be more highly valued. Design concepts may favor larger units that include desk space rather than outdoor community areas that have been trendy within the industry over the past few years. Additionally, community coworking spaces may become more common as the accelerated trend of remote working will make these more of a necessity. However, it will be costly for owners to adapt to these changes, particularly if it becomes a near-requirement to install contact-less features. More owners may shift to virtual tours, video chats and self-guided tours in the -long term to cut operating expenses if these procedures prove to be equally effective as a physical leasing staff.

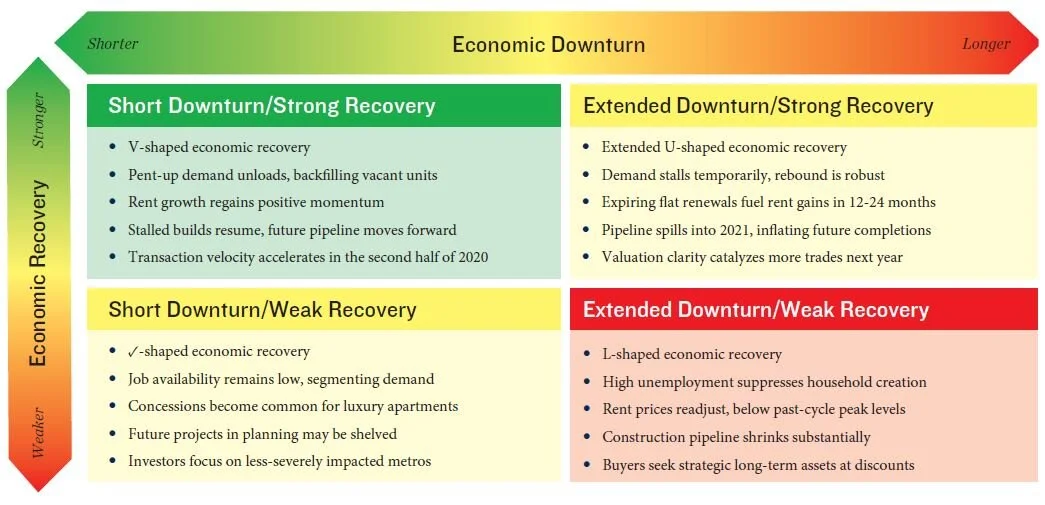

Short Downturn/Strong Recovery

Rapid labor market rebound would unleash pent-up demand, reinvigorating multifamily. Reopening local economies and minimizing the health threat this summer would propel multifamily. Many who lost jobs amid the onset of the pandemic could be re-hired, offsetting the biggest challenge facing the rental industry. Net absorption and leasing activity would accelerate after moves have been put on hold, backfilling units that become vacant once eviction moratoriums expire. This surge in demand would sustain occupancy and support rent growth, keeping the construction pipeline pushing forward to keep pace. Investor sentiment would be restored and buyers and sellers would reenter the arena in force.

Extended Downturn/Strong Recovery

Extended economic downturn would constrain net absorption; momentous recovery would kick-start the next growth cycle. Minimal hiring amid an extended economic downturn would press on the young adult demographic looking to start or advance their careers. More would continue to live at home with parents or seek roommates, slowing household creation until the labor market recovers. Fundamental progress carried from the previous cycle would be paused; however, a swift rebound on the back end would support outsized rent gains to realign with historical growth averages. Delivery volume would contract as projects are delayed, giving way to a substantial pipeline over the next few years. Trading activity would jump at the first signs of a clear recovery.

Short Downturn/Weak Recovery

Slow recovery would suppress job creation, weighing on apartment demand. A relatively short-lasting downturn would mitigate the overall economic impacts of the pandemic, with most job losses being within a few hard-hit sectors. Rental demand within the workforce segment would taper, as lower-skill workers who lost jobs may struggle to find employment during a slow economic recovery. The upper-tier and mid-tier segment may be able to better weather the storm; however, sluggish wage growth would cap rent growth potential. Developers may reanalyze projects in planning and some could be canceled. Buyers will widen their scope and seek acquisitions in markets that are more resilient to the downturn.

Extended Downturn/Weak Recovery

Deep downturn and a lengthy recovery would pose risks to all classes of multifamily. A high-unemployment environment with minimal job availability and fewer raises would impact Class A, B, and C demand. Vacancy would rise as slow household formation causes net absorption to lag behind supply, putting downward pressure on rent as concessions become commonplace. This would significantly alter the construction outlook as developers would become more cautionary and selective in their projects. Risk-tolerant investors may seize this opportunity to acquire long-term assets at reasonable price points after getting outbid over the past few years.

Multifamily Fundamentals Face Hurdles; Construction Pipeline Will Move Forward

True economic vacancy will rise above physical vacancy. The average vacancies across Class A, B, and C apartments entered the year at nearly 20-year lows, providing some cushion against rates rising to the levels recorded during the financial crisis. However, vacancy will likely rise at a notable margin in 2020 with net absorption tapering significantly. The expiration of eviction moratoriums could facilitate the largest temporary surge in vacancy, assuming that courts can process the requests efficiently. From that point forward, units should begin to be backfilled if supported by an economic recovery in the second half of the year. It is also likely that the physical vacancy that will be reported in the coming months will not reveal the true economic vacancy. Eviction moratoriums will allow tenants to occupy units without paying rent, essentially making that unit vacant in the eyes of an owner, without the ability to lease the space out to a new tenant.

Rent growth will be subdued by the use of concessions and flat renewals. Expanded federal unemployment benefits last into July and should provide financial support for renters in the short term. This should negate the need for a rapid decline in asking rents; however, as recommended by industry agencies such as NMHC, many owners have paused rent increases and offered renewals at flat rates to maintain occupancy. This stall in rent growth will push the 2020 year-end gain below historical averages. Rates may even fall in 2020 depending on how the containment of the virus impacts the strength of the economic recovery. Nevertheless, a pause in rent growth will be temporary and may set the stage for outsized gains over the next few years as rent realigns with historical growth trends.

Length of stay-at-home orders will dictate delivery volume, most projects underway will push forward. Mandated stoppages during shelter-in-place orders will delay the 2020 pipeline, and delivery volume will likely fall back into alignment with 2019’s supply additions. A second wave of infections could prompt reinstituted shelter-in-place orders, which would have a more prominent impact. If this is the case, a significant chunk of projects scheduled to deliver this year would be pushed into next year. The 2021 pipeline would then be weighted with delayed 2020 projects. The forward-looking supply pipeline also depends largely on the economic conditions that progress over the second half of this year. If the economic disruption lingers on, more projects may be shelved and supply would contract well below past-cycle averages. However, a large drop-off in construction is unlikely as the demand for rental housing remains significant.

Demographic and Locational Dynamics Will Be Reshaped by the Pandemic

Young adults less likely to pursue homeownership. The multifamily segment has been buoyed by the age 20-34 demographic, which ballooned over the past decade. As millennials age, build up equity and look to start families, the process would translate into an uptick in first-time home buyers. However, the pandemic may delay these plans for the foreseeable future. In a time of economic uncertainty, shorter-term rental leases may be favored over committing to a long-term mortgage. Additionally, the process of buying a home has been made more complex in the aftermath of COVID-19, which could steer potential first-time home buyers away. Millennials, in general, have already shown a willingness to delay homeownership and the pandemic will only strengthen that trend. Single-family houses are no longer seen as a necessary life step, and multifamily has seeped into this demand by offering desirable amenities and convenient access to services.

Quarantines have elevated the value of the living space. Lockdowns forced people to live exclusively within the confines of their dwelling, an unknown experience for many. Those who were under the assumption that their apartment would be merely a place to sleep may have faced the harsh realization that a home is much more than that. Going forward, society may place a higher value on the place they call home, and therefore allocate a larger portion of their budget to find the right space. The rapid adoption of remote working, a trend that will persist beyond the end of the pandemic, will also enhance the value of home. Virtual workers will be spending the majority of their time at their dwelling and may be willing to pay more to secure a space that meets their needs. Many of these will look to reduce roommates, and amenities such as communal printers and office supplies may be high-priority for them.

Urban and suburban trade-offs have been exposed. Small luxury units in dense urban cores may have lost their charm as the realities of spending more time at home have set in. However, urban apartments will continue to benefit from the impracticality of single-family housing in dense areas as well as walkable amenities and easy access to public transit. Suburban rentals have fewer space constraints, which allows larger floor plans and more communal amenities to be built in. Additionally, noise pollution is significantly reduced in suburbs. As more people work remotely, suburban apartments may draw more tenants that no longer need to be close to the central business district. Urban suburban nodes, or pockets on the boundary of cities that incorporate elements of both urban and suburban settings, may be in higher demand moving forward.

State Legislation and the Local Economic Framework Will Differentiate Recoveries

Eviction moratoriums may backlog the court system. Many of the statewide eviction moratoriums that have been enacted expire over the next few months or at the end of declared states of emergency, while evictions at federally backed properties are paused until Au-gust. It is likely that once these moratoriums expire, there will be a wave of eviction notices that have built up after months of appeasement. A surge in eviction fillings over a short period of time could potentially backlog the court systems and essentially extend the eviction moratoriums until the court can process the eviction fillings. This would pose a significant risk, particularly in a rapidly recovering economy, as owners will not be able to capitalize on the uptick in demand if they are waiting for the unit to become unoccupied.

Pent-up demand will unload once society normalizes. With the pandemic coinciding with the busy spring and summer leasing sea-sons, there is the potential for a rapid uptick in activity once emergency orders are lifted. People who have been planning to relocate, or need to move for their job, have had plans put on hold for months. Once individuals feel safe and have the opportunity to move, there may be a wave of leasing activity that helps stabilize the industry in the second half of this year. Pent-up demand may also materialize in spring 2021, as renewals signed during the crisis will come due and tenants may be ready to make a change after an unexpected additional year in the unit. The timing of the disruption has also thrown off the disbursement of college graduates. Many young adults starting their careers seek rental housing, and it is crucial that there are jobs available. If hiring remains stagnant, more young adults will continue to live at home with parents, curtailing occupancy.

Certain rental segments and markets are better suited to weather the storm. The severity and duration of the shock will differ throughout the country. Some of the nation’s most dense cities that are heavily reliant on public transportation will need to reopen at a more gradual pace, weighing on the labor force and burdening renters. Less densely populated markets may be able to kick-start their local economies at a more accelerated pace. The cities’ economic framework will also play a role as the recovery in markets largely supported by tourism and live entertainment will lag behind those more rooted in technology and logistics. More diverse metro economies will be better able to mitigate industry-specific shocks and may see more job openings. The workforce segment as a whole will face challenges during a period of high unemployment. Upper-tier space faces less of a direct impact from job loss, although a slow economic recovery would lead to more layoffs of skilled workers and hurt the luxury rental segment as wage growth is sluggish.

Capital Accumulates on the Sidelines as Investors and Lenders Wait for Clarity; Private Buyers Bolster Their Portfolios Amid Less Competition

Investors will have to rediscover asset values. A disconnect be-tween buyers and sellers as well as financial market constraints will continue to subdue deal flow in the short term. Post-COVID-19 pricing will need to be discovered and rent collection data from the trailing few months will offer some transparency of assets’ value in the near term. However, it will be difficult to translate this back-ward-looking evaluation into a forward-looking projection that establishes a fair market value. As the nation begins to normalize and a larger sample size of rent collections becomes available, the bid/ask spread should tighten as valuation is more discernible. Capital has been building up on the sidelines over the course of the crisis, and positive indicators of an economic recovery will bring many back into the bidding arena, bolstering asset values. Additionally, some transactions on the table at the onset of the pandemic that got postponed or delayed will begin to rematerialize as confidence is restored.

Long-term buyers see a window of opportunity. Many institutional investment groups have paused acquisitions until uncertain-ty dissipates. This is allowing private investors with a long-term mindset to aggressively pursue assets that they may have been get-ting priced out of over the past few years. The long-term outlook for multifamily remains sound and despite the short-term hurdles, quality assets that come to market will lure plenty of bids. At the same time, long-time owners may not want to ride out another cycle or may want to transfer capital gains into less hands-on property types. It could take some time for transaction velocity to return to last cycle’s peak-levels, yet buyer appetite will remain strong and private buyers could look to take advantage of the temporary reduction of bidding competition to bolster their portfolios.

National Multi Housing Group

John Sebree

Senior Vice President, National Director | National Multi Housing Group

Tel: (312) 327-5417 | john.sebree@marcusmillichap.com

Marcus & Millichap Capital Corporation

Tony Solomon

Senior Vice President, National Director | MMCC

Tel: (310) 909-5500 | tony.solomon@marcusmillichap.com

Prepared and edited by

Ben Kunde

Research Associate | Research Services

For information on national commercial real estate trends, contact:

John Chang

Senior Vice President, National Director | Research Services Division

Tel: (602) 707-9700 | john.chang@marcusmillichap.com

The information contained in this report was obtained from sources deemed to be reliable. Every effort was made to obtain accurate and complete information; however, no representation, warranty or guaranty, express or implied, may be made as to the accuracy or reliability of the information contained herein. This is not intended to be a forecast of future events and this is not a guaranty regarding a future event. This is not intended to provide specific investment advice and should not be considered as investment advice.

Sources: Marcus & Millichap Research Services; BLS; CoStar Group, Inc.; Deutsche Bank; Federal Reserve; Freddie Mac; John Burns Real Estate Consulting; National Association of Realtors; Real Capital Analytics; RealPage, Inc.; Small Business Administration; U.S. Census Bureau

© Marcus & Millichap 2020 | www.MarcusMillichap.com