Denver - MULTIFAMILY MARKET REPORT

Multifamily Research - First Half 2019

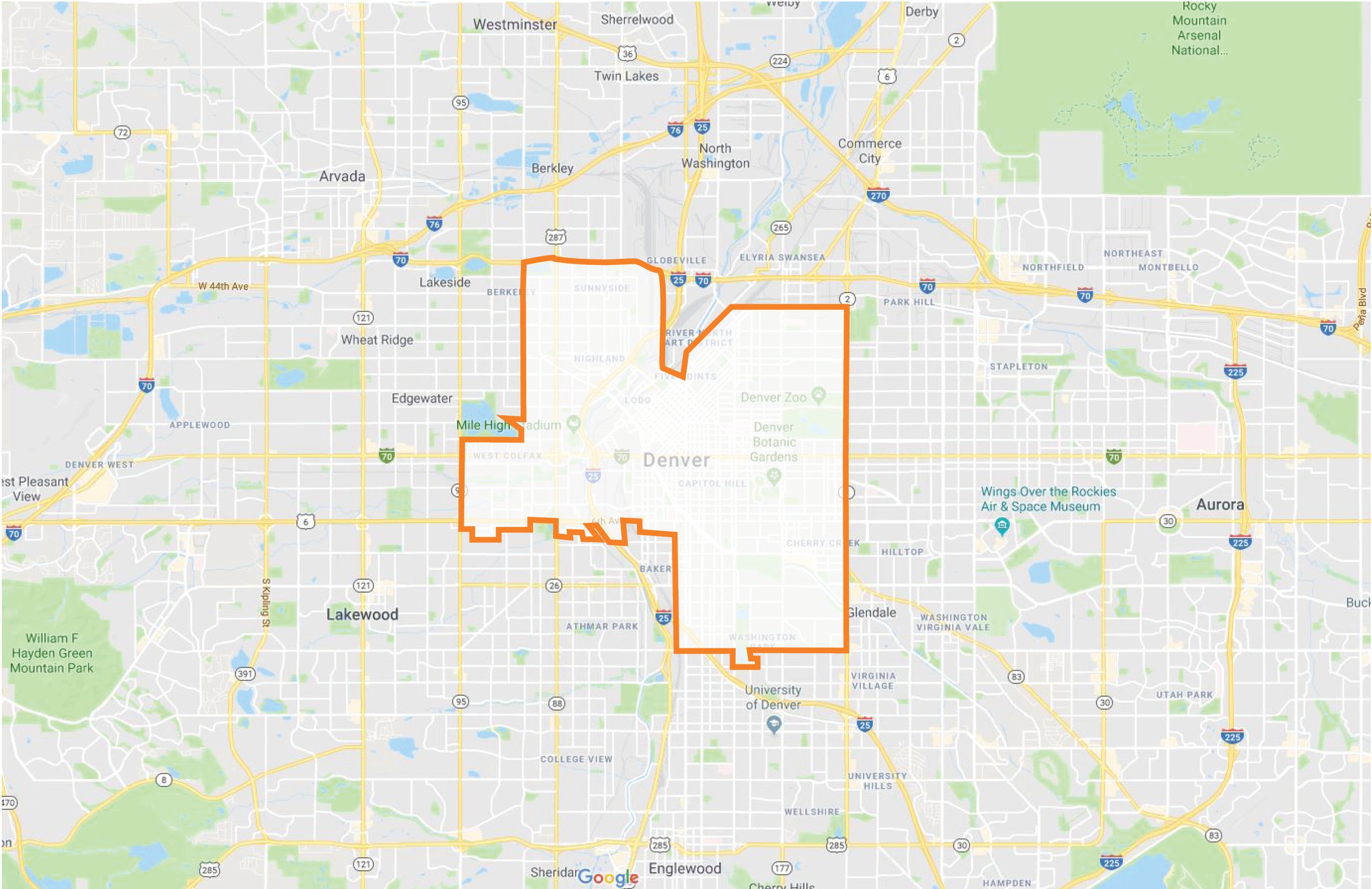

Central Denver Submarket - Denver MSA

Market Highlights

Rising rents direct renters seeking more affordable options in Class C rentals. Employment growth in downtown Denver is boosting demand for housing nearby. The median price of a home with the desired amenities has risen beyond the means of many residents, supporting a growing rental market. Gains in relatively higher-paying tech and business services positions generate demand for highly amenitized units near transit stations in walkable urban neighborhoods, filling the numerous new towers in Central Denver. Multiple buildings beginning leasing efforts this year will drive vacancy in buildings constructed since 2010 above 7 percent. In addition, the average rent in Class A apartments sits above $1,900 per month, directing more renters to look at older Class C buildings in the market for more affordable options. Vacancy in this class tightened to less than 1 percent in the opening quarter of 2019.

Central Denver’s strong rental demand captures investors’ interest. Institutional buyers remain active in the market, many targeting newer Class A buildings with luxury amenities near transit stations. These properties can trade above $400,000 per unit at cap rates that are generally in the 4 percent span but may dip below that for premium buildings. The majority of investors, however, are targeting older Class C assets with fewer than 25 units. Properties with steady cash flows or that have upside potential through building upgrades, changes in management or redevelopment opportunities are desired. Buyers most often targeted assets in the Capitol Hill and Congress Park neighborhoods. These properties traded slightly above the Class C metro average of $190,200 per unit at an average cap rate in the mid-5 percent range. Investors searching for higher returns or entry costs below the metro average should look in the Uptown Denver and Five Points neighborhoods.

Submarket Vital Statistics

Market Map

Construction Trends

Deliveries have fallen sharply year over year in the first quarter as 2,030 rentals were completed, less than half of the 4,100 units finalized one year earlier. Construction is poised to ramp up in the quarters ahead as developers have roughly 5,700 apartments underway with deliveries scheduled into 2021.

Of the 16 projects expected to be completed this year, six are towers with more than 10 stories each containing more than 175 units. The largest is Alexan Arapahoe Square on Park Avenue West, with 355 apartments. The building is located within blocks of a light rail station.

Outlook: This year, the inventory is expected to grow by approximately 3,660 new apartments, the highest annual total in five years.

Rent and Vacancy Trends

A decline in deliveries and strong renter demand over the past four quarters reduced vacancy 10 basis points to 5.6 percent in March, resting slightly above the metro rate of 5.4 percent. Vacancy varies by vintage and is especially tight, at 2.7%, in properties built during the 1970s.

The average effective rent in Central Denver jumped 6.0 percent to $1,860 per month, $380 above the metro average. Rent in properties constructed during the 1970s soared 9.2 percent year over year to $1,339 per month. Even more affordable rent is found in Class C units, at an average of $933 per month in the first quarter.

Outlook: The highest level of new inventory in five years will push vacancy up to 7.0 percent at year’s end, as supply temporarily outpaces demand. The average effective rent will stagnate, remaining near $1,860 per month in 2019 as operators expand concessions to fill units.

Sales Trends

During the past four quarters, deal flow decreased as the number of quality for-sale listings tightened. Many owners with strong cash flows are reluctant to divest.

Overall, cap rates averaged in the low-5 percent range in the first quarter, up 40 basis points year over year. First-year returns for buildings constructed before 1990 were on par with the metro average, while those built since 1990 were 40 basis points lower on average.

Outlook: Strong apartment demand will continue to attract investors to Central Denver. Many buyers will seek older Class C properties with a steady cash flow.

Multifamily Market Report; Denver, Colorado